wgcasino11.ru Tools

Tools

How Much Do Three Season Rooms Cost

Installing a three season room can cost between $8, and $50, on average nationally. As the most enclosed form of an outdoor living space, it has the most. Three-season rooms take the outdoor protection a step up, often Having one added to your home, may cause you to wonder “How much does each cost? The cost range of a three-season room is between $10, and $40, with an average of $25, While this is just one type of sunroom (as they vary widely. Enjoy the outdoors in the comfort of your home from spring to fall with a three season room. How much do 3 season and hybrid rooms cost? Since every project. The cost generally ranges from about $10, to $40, for a three-season room, depending on the size and complexity of the space. Prefabricated sunroom kits. Enjoy the outdoors in the comfort of your home from spring to fall with a three season room. How much do 3 season and hybrid rooms cost? Since every project. According to Home Guide, a three season room can cost between $8, to $50, depending on size and features. Screened-in porches often do not provide a climate-controlled space. · Essentially, screened-in porches are a 1-season room, usable for approximately three. While average screen room pricing starts around $, a more standard sunroom, rooms with fully enclosed glass, could range all the way up to $ Installing a three season room can cost between $8, and $50, on average nationally. As the most enclosed form of an outdoor living space, it has the most. Three-season rooms take the outdoor protection a step up, often Having one added to your home, may cause you to wonder “How much does each cost? The cost range of a three-season room is between $10, and $40, with an average of $25, While this is just one type of sunroom (as they vary widely. Enjoy the outdoors in the comfort of your home from spring to fall with a three season room. How much do 3 season and hybrid rooms cost? Since every project. The cost generally ranges from about $10, to $40, for a three-season room, depending on the size and complexity of the space. Prefabricated sunroom kits. Enjoy the outdoors in the comfort of your home from spring to fall with a three season room. How much do 3 season and hybrid rooms cost? Since every project. According to Home Guide, a three season room can cost between $8, to $50, depending on size and features. Screened-in porches often do not provide a climate-controlled space. · Essentially, screened-in porches are a 1-season room, usable for approximately three. While average screen room pricing starts around $, a more standard sunroom, rooms with fully enclosed glass, could range all the way up to $

Add living space at a fraction of the cost of conventional construction, and have a place where everyone wants to be. For outdoor entertaining without rain. Both all-season and three-season sunrooms give you more space to do all the things you love. Add Market Value. Whether or not you're adding square footage to. The cost of a 3 season room can range anywhere from $10, to $70, The range in cost is so large because of a variety of factors. Materials, labor, the. We recently had a quote done for a similar setup last week except a bit smaller 12x16 and it came out to 97k! Three-season rooms typically cost between $10, and $40, Glass While a three-season sunroom may not require many doors, a four-season sunroom. The cost range of a three-season room is between $10, and $40, with an average of $25, While this is just one type of sunroom (as they vary widely. Four season rooms are generally much more expensive than three season rooms, as this constitutes for a deep “surgical intervention” in your existing home. Three Season Rooms can range from $20, – $45, How long does it take to install a screen room? It takes one of our crews. On average, a three season room can cost between $40, to $85, or more. Will a three season room add value to my home? Price Range: Three Season Rooms are very reasonably priced. They often range from $ – $ with the average price coming in below $ Get An Estimate. On average, a basic three-season room costs around $15,, while more elaborate designs and features can raise the investment to $50, or more. How long does. Construction of a four-season room can range in cost from $10, to $20, at the low end to as high as $72, to $,+. Again, your geographical. You may be wondering 'But how much does a three season room cost?' Let Distinctive Deck Designs proudly builds three season rooms for homeowners in the three. Four season rooms are generally much more expensive than three season rooms, as this constitutes for a deep “surgical intervention” in your existing home. Price Range: Three Season Rooms are very reasonably priced. They often range from $ – $ with the average price coming in below $ Get An Estimate. Reduces cooling costs by as much as 25% in summer; Saves your fabric by blocking UV rays 90% more effectively than ordinary glass (more if you add a glass. Cost-Effective and Comfortable Three-Season Rooms. Joyce Sunrooms are built If you aren't sure which sunroom addition or enclosed patio would be. should work with our Iowa sunroom installation company to install your seasons rooms. About Our Custom Three-Season and Four-Season Rooms. Our sunrooms. Homeowners who are looking to add interior living space often opt for adding sunrooms, because of their openness, visibility, and cost-effectiveness compared to. Both all-season and three-season sunrooms give you more space to do all the things you love. Add Market Value. Whether or not you're adding square footage to.

How Long Own House Before Selling

Potential Downside of Selling a House Before 2 Years. If you sell your home before you've owned it for at least two years, you're less likely to earn much of a. the last 9 months you owned the home - even if you were not living there at the time. If you sold the property between 6 April and 6 April , you get. The property was not owned and used as the seller's principal residence for at least two of the last five years prior to the sale (some exceptions apply). The. This means the total home buying process can easily take over three months time once you add in time for house hunting and account for complications or hiccups. After 30 years, your loan is paid off and you own the property outright. You don't have to wait until you sell to take advantage of equity, however. In this blog, we discuss the topic of buying a house before selling your own. This includes strategies to buy first, and when it is actually best to buy before. You should probably hold off on selling your property until you've owned it for at least two years. Doing so will prevent you from having to meet the capital. However, recognize that most of the listing agent's job is done before the house It's hard to be objective when it comes to selling your own home. Regardless. Wait to sell: You bought or refinanced in the last couple of years. · Wait to sell: You're worried about affording your next purchase. · Wait to sell: You're. Potential Downside of Selling a House Before 2 Years. If you sell your home before you've owned it for at least two years, you're less likely to earn much of a. the last 9 months you owned the home - even if you were not living there at the time. If you sold the property between 6 April and 6 April , you get. The property was not owned and used as the seller's principal residence for at least two of the last five years prior to the sale (some exceptions apply). The. This means the total home buying process can easily take over three months time once you add in time for house hunting and account for complications or hiccups. After 30 years, your loan is paid off and you own the property outright. You don't have to wait until you sell to take advantage of equity, however. In this blog, we discuss the topic of buying a house before selling your own. This includes strategies to buy first, and when it is actually best to buy before. You should probably hold off on selling your property until you've owned it for at least two years. Doing so will prevent you from having to meet the capital. However, recognize that most of the listing agent's job is done before the house It's hard to be objective when it comes to selling your own home. Regardless. Wait to sell: You bought or refinanced in the last couple of years. · Wait to sell: You're worried about affording your next purchase. · Wait to sell: You're.

Start trying to sell your home in April or May and continue to promote it throughout the summer. If you haven't sold it by late fall, scale back your efforts. How Long Does It Take To Buy a House From Start to Finish? There is no set timeline for purchasing a home. If the process goes smoothly, it may take four. This is because the whole concept of buying a new home before selling your own house is an enormous risk. This may mean borrowing more money. Otherwise, you may. Be sure to use only sold homes that are similar to the one you're researching, and usually, you should only go back one year. So the prices of similar homes. selling your own house. But possible pitfalls are: The time factor. With Before listing a property yourself and inviting prospective buyers in, O. Selling a home takes about 5 months on average. The process can take longer if you're part of a chain of buyers and sellers. According to a recent study by ATTOM Data Solutions, most people wait until the summer to sell, with June, July and August accounting for the most home sales. Pros and Cons of Buying a House Before Selling Your Current House ; You can collect passive income by renting your old house, You won't be able to use home sale. Judging by the feedback, many people had never heard of this before, even though it has been around for a very long time. Sometimes it's called a lease purchase. to sell and buy a new house every few years. Location criteria to consider before the s, only four in 10 American families owned their own home. The Best Financial Strategies for Buying Another House Before Selling Yours · Option 1: Use a Buy-Before-You-Sell Program · Option 2: Pay Two Mortgages for a. You may be able to earn money to cover your soon-to-be mortgage payment by offering the existing occupants extra time to stay while you sell your property. “. the last 9 months you owned the home - even if you were not living there at the time. If you sold the property between 6 April and 6 April , you get. This can be as simple as a deep clean, or even some home repairs. You'll want to be as honest as possible in your listing about the state of the house, so if. Whether you're working with an agent or selling your home on your own How long does it take to sell a house? On average, homes in the U.S. spend. Selling your house is a big decision. There are a lot of factors to consider before posting the sign in your front lawn. How Much Is My House Worth? U.S. Ownership Test: You owned the home for two or more years during the five-year selling or plan to sell your home, there is important information to keep in. You may exclude the first $, of gain—as long as you've lived there for two years before selling, or meet one of the IRS exceptions to that rule. Co. Sellers typically lived in their home for 10 years before selling. Among FSBOs typically sell for less than the selling price of other homes; FSBO homes. how long you've owned the property. The You could also make the property your primary residence for two of the five years before selling the home.

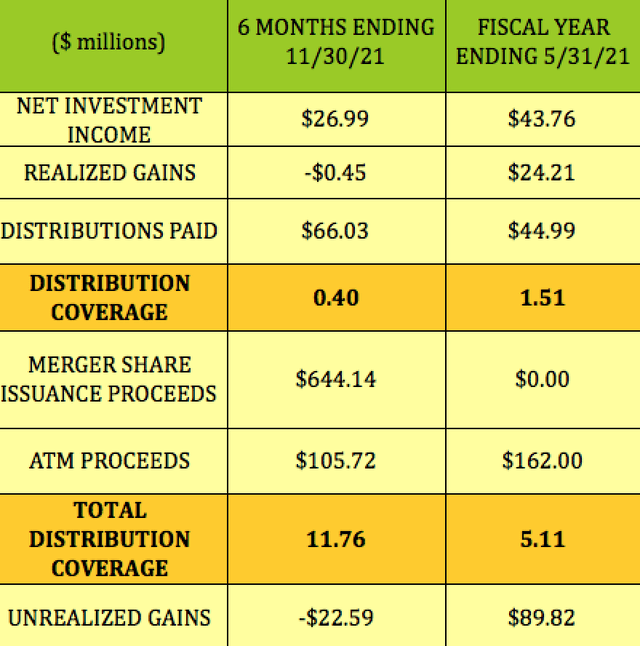

Gof Stock Dividend

GOF pays a solid dividend yield of %, which is higher than the average of the bottom 25% of dividend payers in the US market (%). GOF's dividend yield. I have 4, shares of GOF and 3, shares of PDI. It gets me just over a month. I've been using the dividends to add to the other stocks. GOF pays a dividend of per share. GOF's annual dividend yield is %. When is Guggenheim Strategic Opportunities Fund ex-dividend date? Find the latest Guggenheim Strategic Opportunities Fund (GOF) stock quote Forward Dividend & Yield (%); Ex-Dividend Date Oct 12, ; 1y. Does Guggenheim Strategic Opportunities Fund (GOF) stock pay dividends? Yes, it has. In this post, you will find the past dividend dates and payouts. Also noted they need to give this high monthly dividend by dilluting their common stock and it's value drops. By all means I did not expect to. View dividend data for Guggenheim Strategic Opportunities Common Shares Of Beneficial Interest (GOF) including upcoming dividends, historical dividends. GOF's dividend yield, history, payout ratio & much more! Dividend Quickest stock price recoveries post dividend payment. This trading strategy. GOF Dividend: for Sept. 13, · Dividend Chart · Historical Dividend Data · Dividend Definition · Dividend Range, Past 5 Years · Dividend Benchmarks. GOF pays a solid dividend yield of %, which is higher than the average of the bottom 25% of dividend payers in the US market (%). GOF's dividend yield. I have 4, shares of GOF and 3, shares of PDI. It gets me just over a month. I've been using the dividends to add to the other stocks. GOF pays a dividend of per share. GOF's annual dividend yield is %. When is Guggenheim Strategic Opportunities Fund ex-dividend date? Find the latest Guggenheim Strategic Opportunities Fund (GOF) stock quote Forward Dividend & Yield (%); Ex-Dividend Date Oct 12, ; 1y. Does Guggenheim Strategic Opportunities Fund (GOF) stock pay dividends? Yes, it has. In this post, you will find the past dividend dates and payouts. Also noted they need to give this high monthly dividend by dilluting their common stock and it's value drops. By all means I did not expect to. View dividend data for Guggenheim Strategic Opportunities Common Shares Of Beneficial Interest (GOF) including upcoming dividends, historical dividends. GOF's dividend yield, history, payout ratio & much more! Dividend Quickest stock price recoveries post dividend payment. This trading strategy. GOF Dividend: for Sept. 13, · Dividend Chart · Historical Dividend Data · Dividend Definition · Dividend Range, Past 5 Years · Dividend Benchmarks.

Discover real-time Guggenheim Strategic Opportunities Fund Common Shares of Beneficial Interest (GOF) stock Flowers Foods Named Top Dividend Stock With. Try Dividend Investor PREMIUM for as low as $29 · Sep. 03, DIVIDEND ANNOUNCEMENT: Com Shs Of Ben Int/Guggenheim Strategic Opportunities Fund (NYSE: GOF) on. (GOF) has announced a dividend of $ with an Sign up for a Stock Events account to create your own watchlists and track your portfolio or dividends. Symbol / Exchange: GOF / XNYS. Value: € Dividend frequency: monthly. Security Type: Equity. Dividend Currency: US Dollar. 15 Countries. United States. GOF has an annual dividend of $ per share, with a yield of %. The dividend is paid every month and the next ex-dividend date is Sep 13, Dividend. Guggenheim Strategic Opportunit (GOF) - Payout Ratio History. Dividends · Price · Payout Ratio. Payout ratio history for stock GOF (Guggenheim Strategic. Does Guggenheim Strategic Opportunities Fund(GOF) pay dividends? If so, how much? The Dividend Yield % of Guggenheim Strategic Opportunities Fund(GOF) is %. GOF (Guggenheim Strategic Opportunities Fund) Dividend Payout Ratio as of today (September 04, ) is Dividend Payout Ratio explanation, calculation. Com Shs Of Ben Int/Guggenheim Strategic Opportunities Fund Annual Stock Dividends ; , ; , ; , ; , View today's Guggenheim Strategic Opportunities Closed Fund stock price and latest GOF news and analysis. Create real-time notifications to follow any. Last Announced Dividend. Amount. $ Ex-Div Date. 09/13/ GOF's dividend yield, history, payout ratio & much more! wgcasino11.ru: The #1 Source For Dividend Investing. GOF Dividend Yield History ; %, %, %, % ; %, %, %, %. When considering the Guggenheim Strategic Opportunities Fund stock dividend history, we have taken known splits into account, such that the GOF dividend history. Tomorrow's Ex-Dividends To Watch: OAKS, GOF, DBL. OAKS GOF DBL are going ex-dividend tomorrow, Wednesday, July 13, OAKSGOFDBL ; 3 Stocks With Upcoming Ex-. GOF Dividend Yield: % for Sept. 9, · Dividend Yield Chart · Historical Dividend Yield Data · Dividend Yield Definition · Dividend Yield Range, Past 5. The annual dividend for GOF shares is $ Learn more on GOF's annual dividend history. How often does Guggenheim Strategic Opportunities Fund pay dividends? 7, is USD. The forward dividend yield for GOF as of Sept. 7, is %. 01/01/ Inception Date, 7/26/ ; NYSE Symbol, GOF ; NAV Symbol, XGOFX ; CUSIP, F ; Inception Market Price, $ Explore Guggenheim Strategic Opportunities Fund stock dividend history, dividend yield range, next GOF dividend date, and Guggenheim Strategic Opportunities.

Ucb Data Science Major

She is one of students who made these subjects the second most common combination of majors declared on campus this spring. Learn more about how Shrinidhi. UC Berkeley - Offers a Bachelor of Arts (BA) degree in Data Science / Ranked #1 for data science majors in the US out of 24 schools; UC Irvine - Offers a BS. I am a data science major at UC Berkeley. What should I do? Will I still be able to get a lucrative career in computer science/Software. The course meets the Human Contexts and Ethics requirement of UC Berkeley's Data Science major. It gives Data Science majors systematic exposure and. The average UC Berkeley Data Scientist earns an estimated $k annually, which includes an estimated base salary of $k with a $28k bonus. Design curriculum materials for training data science ambassadors UC Berkeley a separate dedicated Data Science Major. The main barrier has been a broad. Around students are majoring in Data Science and – students are minoring in Data Science at Cal. And U.S. News & World Reports. What I Needed From a Data Science Program. A Legitimate Master's Degree with a Brand Value and Credibility. If I was going to dedicate time and. The Data Science Program at UC Berkeley is highly regarded for its comprehensive curriculum and strong focus on both theoretical and practical. She is one of students who made these subjects the second most common combination of majors declared on campus this spring. Learn more about how Shrinidhi. UC Berkeley - Offers a Bachelor of Arts (BA) degree in Data Science / Ranked #1 for data science majors in the US out of 24 schools; UC Irvine - Offers a BS. I am a data science major at UC Berkeley. What should I do? Will I still be able to get a lucrative career in computer science/Software. The course meets the Human Contexts and Ethics requirement of UC Berkeley's Data Science major. It gives Data Science majors systematic exposure and. The average UC Berkeley Data Scientist earns an estimated $k annually, which includes an estimated base salary of $k with a $28k bonus. Design curriculum materials for training data science ambassadors UC Berkeley a separate dedicated Data Science Major. The main barrier has been a broad. Around students are majoring in Data Science and – students are minoring in Data Science at Cal. And U.S. News & World Reports. What I Needed From a Data Science Program. A Legitimate Master's Degree with a Brand Value and Credibility. If I was going to dedicate time and. The Data Science Program at UC Berkeley is highly regarded for its comprehensive curriculum and strong focus on both theoretical and practical.

The UC Berkeley Modules Student Team was an early initiative of UC Berkeley Data Science Science Major, and led to extensive training, documentation. Data Science major Yara jotted down some of the wisdom she's gained during her first year at UC Berkeley - read the full blog below! Day in the Life: Data Science and Psychology DOUBLE MAJOR [UC Berkeley]. Rachel Lin · · Day in the Life: Pre-Law student GOING to Law. The UC Berkeley Foundations of Data Science course combines three perspectives: inferential thinking, computational thinking, and real-world relevance. Given. In the last couple years, data science has grown tremendously at UC Berkeley. More than students have now graduated with a data science. I graduated from UC Berkeley in May from the College of Letters and Science. I loved it here, and this school opened so many opportunities for me in. It's 'go time!' The UC Berkeley L&S Data Science Major can now be officially declared! Bachelor of Data Science in Data Science and Data Analytics is one of the most favoured degree programs undertaken by students from the University of. The board's unanimous confirmation makes Lyons, 63, the first UC Berkeley undergraduate alumnus since to become the campus's top leader. In an interview. UC Berkeley Programs B.A[Data Science]. University of California logo The Data Science Major degree program combines computational and inferential. Data Science at UC Berkeley. We compiled insight from our club What other majors could complement your data science major based on the fields. Followers, Following, Posts - UC Berkeley College of Computing, Data Science, and Society (@berkeleydatasci) on Instagram: "The. After signing an agreement, THU and UC Berkeley launched their dual degree program in Fall of Data Science & Information Technology. MS Research Area. Construction workers placed the final steel beam onto the building, recognition of a major milestone for the future home of Berkeley's first new. Admissions. UC Berkeley seeks candidates who want to make a positive impact on the I School community and the world. In addition to holding a bachelor's degree. Course Level. UG Degree ; Mode of Course. Full Time ; International Students Admission Website. Go to Website External Link Icon ; Tuition & Fees. ₹ Lakh. AY / UC Berkeley Astronomy Data Lab · Site logo This course satisfies the Data Science major requirement for “Computational & Inferential Depth”. Registration opens for online master's degree program that will teach analytic and statistical methods for making sense of big data. Intro CS for Majors. Intro CS for Non-Majors. Foundations of Data Science. Programming for Engineers. Page 4. Design Goals for a Data Science Major. • Develop. Data Science and one of the pioneers of the Data Science major at Cal. We are a group of undergraduate students at UC Berkeley focused on helping promote Data.

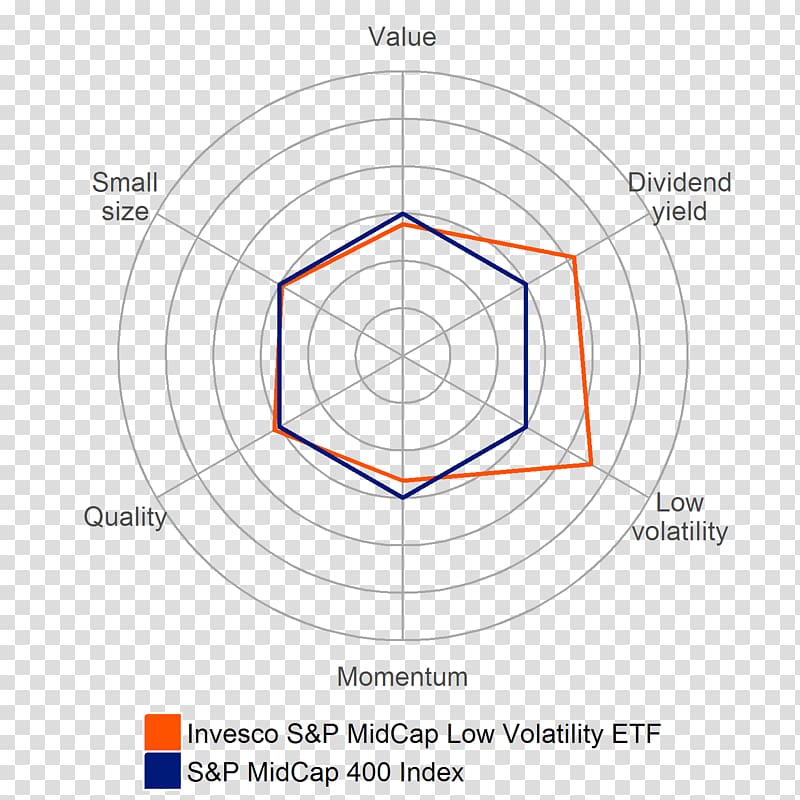

Invesco Exchange Traded Fd Tr S&P 500

The Index tracks the performance of stocks in the S&P ® Index that have a high "momentum score". The Fund and Index are reconstituted and rebalanced twice a. View Invesco Exchange Traded Fd Tr S&P Equal Weight Etf (RSP) stock price, news, historical charts, analyst ratings, financial information and quotes on. The fund seeks total return through growth of capital and current income. as of 08/31/ Morningstar Rating ™. Overall Rating - Large Blend Category. As of. A market capitalization-weighted index of common stocks chosen for market size, liquidity, and industry group representation to represent US equity. Invesco S&P ® Equal Weight ETF exchange traded fund overview and insights The ETF has 1 primary benchmark: S&P Equal Weighted TR USD index with a. Find the Invesco Exchange Traded Fd Tr S&P Equal Weight Etf (RSP) options chain including strike prices, expiration dates, and volume data on Moomoo's. Find the latest Invesco S&P Equal Weight ETF (RSP) stock quote, history, news and other vital information to help you with your stock trading and. Find the latest Invesco S&P GARP ETF (SPGP) stock quote, history, news and other vital information to help you with your stock trading and investing. The Invesco S&P Quality ETF (Fund) is based on the S&P Quality Index (Index).The Fund will normally invest at least 90% of its total assets in common. The Index tracks the performance of stocks in the S&P ® Index that have a high "momentum score". The Fund and Index are reconstituted and rebalanced twice a. View Invesco Exchange Traded Fd Tr S&P Equal Weight Etf (RSP) stock price, news, historical charts, analyst ratings, financial information and quotes on. The fund seeks total return through growth of capital and current income. as of 08/31/ Morningstar Rating ™. Overall Rating - Large Blend Category. As of. A market capitalization-weighted index of common stocks chosen for market size, liquidity, and industry group representation to represent US equity. Invesco S&P ® Equal Weight ETF exchange traded fund overview and insights The ETF has 1 primary benchmark: S&P Equal Weighted TR USD index with a. Find the Invesco Exchange Traded Fd Tr S&P Equal Weight Etf (RSP) options chain including strike prices, expiration dates, and volume data on Moomoo's. Find the latest Invesco S&P Equal Weight ETF (RSP) stock quote, history, news and other vital information to help you with your stock trading and. Find the latest Invesco S&P GARP ETF (SPGP) stock quote, history, news and other vital information to help you with your stock trading and investing. The Invesco S&P Quality ETF (Fund) is based on the S&P Quality Index (Index).The Fund will normally invest at least 90% of its total assets in common.

RSP – Invesco S&P ® Equal Weight ETF – Check RSP price, review total assets, see historical growth, and review the analyst rating from Morningstar. The Invesco S&P GARP ETF (Fund) is based on the S&P Growth at a Reasonable Price Index (Index). The Fund will invest at least 90% of its total assets. Analytics and Ownership details of Invesco Exchange Traded Fd Tr | INVESCO S&P | Country: US | Sec Type: EC-RF | Cusip: V | Isin: USV The Invesco S&P Revenue ETF (Fund) is based on the S&P Revenue-Weighted Index (Index). The Fund will invest at least 90% of its total assets in. Twenty years ago, the Invesco S&P Equal Weight ETF (ticker: RSP) helped reinvent how clients access the S&P If you're invested in funds that track. Real time Invesco Exchange-Traded Fund Trust II - Invesco S&P High Dividend Low Volatility ETF (SPHD) stock price quote, stock graph, news & analysis. Invesco Exchange-Traded Fund Trust II - Invesco S&P Revenue ETF live share price at 3 a.m. on Jun 11, is US$ Explore financials, technicals. The Invesco S&P High Dividend Low Volatility ETF (Fund) is based on the S&P Low Volatility High Dividend Index (Index). The Invesco S&P Low Volatility ETF (Fund) is based on the S&P Low Volatility Index (Index). The Fund will invest at least 90% of its total assets in. RSP Invesco Exchange Traded Fd Tr S&P Equal Weight Etf. Close Aug 26 ET. %. High Low The Invesco S&P Pure Value ETF (Fund) is based on the S&P Pure Value Index (Index). The Fund will invest at least 90% of its total assets in securities. The Fund will invest at least 90% of its total assets in securities that comprise the Index. The Index equally weights the stocks in the S&P ® Index. The. The Invesco S&P Low Volatility ETF (Fund) is based on the S&P Low Volatility Index (Index). The Fund will invest at least 90% of its total assets in. The Fund is reconstituted and rebalanced twice a year. Address. Invesco Exchange-Traded Fund Trust Lacey Road Suite Downers Grove, IL USA. INVESCO EXCHANGE TRADED FD TR S&P PURE VALUE ETF (AMEX: RPV). Overview. current price. $ change. | %. Yesterday's Close. open. The Invesco S&P BuyWrite ETF Exchange Traded Fund (ETF) by Invesco exposes you to an alternative index, which stretches beyond traditionnal assets (such. QQQ · Invesco QQQ Trust Series I, Equity, $,, % ; RSP · Invesco S&P ® Equal Weight ETF, Equity, $61,, %. The Invesco S&P BuyWrite ETF Exchange Traded Fund (ETF) by Invesco exposes you to an alternative index, which stretches beyond traditionnal assets (such. Open-end mutual funds and exchange-traded funds are considered a single population for comparison purposes. Ratings are calculated for funds with at least a. INVESCO EXCHANGE TRADED FD TR S&P PURE VALUE ETF (AMEX: RPV). Overview. current price. $ change. | %. Yesterday's Close.

Top Ten Travel Credit Cards

Between the two, the Delta Platinum card seems to be the better choice. Keep in mind that with the Delta Platinum or Reserve card, you lose some. Best features: The VentureOne card is a basic travel card for beginners who want to earn flexible rewards but aren't ready to commit to an annual fee (See rates. Best Business Credit Cards for Travel · Best No Annual Fee Travel Credit Cards · Best Travel Credit Cards For Fair Credit · Best Credit Card For Lounge Access. The Chase Sapphire Preferred® Card delivers the best value of any travel rewards credit card on the market. On this measure, the top travel credit cards offer. Best Credit Cards for Travel: Our Picks for ; Capital One Venture Rewards Credit Card - Generous travel rewards ; Wells Fargo Propel American Express Credit. Travel Rewards for Good Credit. 6, reviews ; 20, Bonus Miles + No Annual Fee. 6, reviews ; Earn up to $1, in travel bonuses. 10, reviews ; Premium. Capital One Venture Rewards Credit Card: Best for earning miles · Capital One Venture X Rewards Credit Card: Best for premium travel · Chase Sapphire Preferred®. 7 Best Travel Credit Cards ; 1. Capital One Venture X ·: Luxury travel ·: $ · Rewards can be redeemed for travel expenses. ; 2. Chase Sapphire Preferred ·. We analyzed dozens of popular travel cards and dug into each one's perks and drawbacks to find the best travel credit cards based on your spending habits. Between the two, the Delta Platinum card seems to be the better choice. Keep in mind that with the Delta Platinum or Reserve card, you lose some. Best features: The VentureOne card is a basic travel card for beginners who want to earn flexible rewards but aren't ready to commit to an annual fee (See rates. Best Business Credit Cards for Travel · Best No Annual Fee Travel Credit Cards · Best Travel Credit Cards For Fair Credit · Best Credit Card For Lounge Access. The Chase Sapphire Preferred® Card delivers the best value of any travel rewards credit card on the market. On this measure, the top travel credit cards offer. Best Credit Cards for Travel: Our Picks for ; Capital One Venture Rewards Credit Card - Generous travel rewards ; Wells Fargo Propel American Express Credit. Travel Rewards for Good Credit. 6, reviews ; 20, Bonus Miles + No Annual Fee. 6, reviews ; Earn up to $1, in travel bonuses. 10, reviews ; Premium. Capital One Venture Rewards Credit Card: Best for earning miles · Capital One Venture X Rewards Credit Card: Best for premium travel · Chase Sapphire Preferred®. 7 Best Travel Credit Cards ; 1. Capital One Venture X ·: Luxury travel ·: $ · Rewards can be redeemed for travel expenses. ; 2. Chase Sapphire Preferred ·. We analyzed dozens of popular travel cards and dug into each one's perks and drawbacks to find the best travel credit cards based on your spending habits.

Why We Like It: The best travel credit card overall is the Chase Sapphire Preferred® Card because it has a great initial bonus and gives you at least double. The Chase Sapphire Preferred Card is the best international travel credit card for most globetrotters, thanks to its attractive welcome bonus, reasonable. General travel rewards credit card · Co-branded airline rewards credit card · Co-branded hotel rewards credit card · Take advantage of a sign-up bonus · Select a. Compare the best travel cards with no annual fee. Best Credit Cards Under 5/24 ; 1. Chase Sapphire Preferred® Card ; 2. Chase Ink Business Unlimited® Credit Card ; 3. Chase Ink Business Preferred® Credit Card ; 4. **Chase Sapphire Reserve® Our Top Pick. Other cards in the Venture family and the ever-popular Chase Sapphire Preferred® Card and Chase Sapphire Reserve® cards are nearly as good, however, so read on. Hear from our editors: The best travel rewards credit cards of September · Best for premium rewards: Chase Sapphire Reserve® · Best for luxury perks. Some rewards cards come with great travel-specific benefits like credits on hotel travel or access to priority pass airport lounges. Check out the Travel On Point(s) Credit Card Recommendations for every award category! Refreshed each month to reflect the most up-to-date offers! The best travel credit cards offer outstanding rewards, big sign-up bonuses and low fees. Read our recommendations for the best travel rewards. Venture X, CSP and CSR are all good travel cards to consider with decent SUBs, multipliers, and good travel insurances, no FTF, and with airline. We've ranked the best credit card offers below with an eye toward those that can help you book luxury travel. Travel Rewards Credit Cards ; Capital One Venture offers 75, bonus miles when you spend $4, on purchases in the first 3 months. A relatively common travel card benefit is a membership fee credit for Global Entry or TSA PreCheck®. It's the cardholder's choice which program to use it for. We've ranked the best credit card offers below with an eye toward those that can help you book luxury travel. The Chase Sapphire Preferred® Card is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns. These credit cards provide good travel rewards, 0% foreign transaction fees, and other protections like trip delays or cancellations to help you travel with. Travel Credit Cards · Chase Sapphire Preferred Credit Card. · Chase Sapphire Preferred Credit Card card reviews. Rated out of 5 (7, cardmember reviews). That's $ when you redeem through Chase Travel℠. High APRs. This is not a great card for people who carry a balance. It has a variable purchase APR that.

African Owned Banks

Black banks are an endangered species. As they die, so does opportunity for communities of color. Community-focused Black banks wield tremendous local. Capital Savings Bank provided the capital essential to the growth of black businesses, capital that white-owned banks were unwilling to lend. The community. There are minority-owned financial institutions in the United States. Taken together, they have approximately $ billion in assets in total. An MDI may be a federal insured depository institution for which (1) 51 percent or more of the voting stock is owned by minority individuals; or (2) a majority. There are minority-owned financial institutions in the United States. Taken together, they have approximately $ billion in assets in total. In , local African American businessmen acquired Unity National Bank of Houston. We have experienced growth and success as our customers and community. list of all Black-owned banks and Black-led banks in the U.S. · Commonwealth National Bank (HQ: Alabama) · Citizens Trust Bank (HQ: Georgia) · Carver State. Black Banks PDFhere. Decades before the dawn of the Civil War there were discussions about creating black-owned banks in the United States. These. 21 black-owned banks continue to support many African-Americans as a wealth-building tool. They have total assets of more than $ billion. Black banks are an endangered species. As they die, so does opportunity for communities of color. Community-focused Black banks wield tremendous local. Capital Savings Bank provided the capital essential to the growth of black businesses, capital that white-owned banks were unwilling to lend. The community. There are minority-owned financial institutions in the United States. Taken together, they have approximately $ billion in assets in total. An MDI may be a federal insured depository institution for which (1) 51 percent or more of the voting stock is owned by minority individuals; or (2) a majority. There are minority-owned financial institutions in the United States. Taken together, they have approximately $ billion in assets in total. In , local African American businessmen acquired Unity National Bank of Houston. We have experienced growth and success as our customers and community. list of all Black-owned banks and Black-led banks in the U.S. · Commonwealth National Bank (HQ: Alabama) · Citizens Trust Bank (HQ: Georgia) · Carver State. Black Banks PDFhere. Decades before the dawn of the Civil War there were discussions about creating black-owned banks in the United States. These. 21 black-owned banks continue to support many African-Americans as a wealth-building tool. They have total assets of more than $ billion.

In this blog, we will explore the history of black owned banks in America and highlight the top 5 black owned banks that are making a significant impact in. There are over 35 Black owned banks and credit unions in the United States where you could consider putting your money. Check out the list below! Black-owned banks · Black-Owned Bank Celebrates Years In Business During Black History Month · Black Investor Group Redemption Holding Company Makes. OneUnited Bank is the first Black internet bank and the largest Black owned bank in the country, with offices in Los Angeles, Boston and Miami. Bank Black. The first Black-owned bank to officially open was Capital Savings Bank in October of Over the next several decades, Black-owned banks. The nation's largest Black-owned bank. National reach, local touch. Dedicated to help you achieve financial empowerment with purpose driven AI solutions. Capital Savings Bank, the first Black bank, opened in Washington, DC, in Shortly after, the Savings Bank of the Grand Fountain United Order of True. Today they're the team behind the COWRIE Initiative, which leads BankBlackUSA—an independent activation with a mission to promote financial advocacy in Black. Black-owned banks and credit unions focus lending on small businesses, nonprofits, and African American home-buyers, while maintaining a focus on predominantly. In this blog, we highlight some of the best Black-owned banks for small businesses, their lending criteria, and the types of financing they offer. A clickable list of over Black-owned banks and credit unions. Collection include short, captivating, informative videos plus an interactive desktop map. Black-owned and black-customer service oriented banks and insurance companies were formed out of the exclusion of African Americans from these systems, and. 38 Black Owned Banks And Credit Unions: Putting Your Money Where It Counts · Omega Psi Phi Credit Union – Lawrenceville, Georgia · Phi Beta Sigma Federal Credit. Today there is only one Black-owned Bank in Virginia, the Virginia State University Federal Credit Union. This institution got its start as the Virginia State. Black Bank Locations ; ALAMERICA BANK, BIRMINGHAM, AL ; BROADWAY FEDERAL BANK FSB, LOS ANGELES, CA ; CARVER FEDERAL SAVINGS BANK, NEW YORK, NY ; CARVER STATE BANK. Decades before the dawn of the Civil War there were discussions about creating black-owned banks in the United States. For the first African American banks. The list of Black-owned financial institutions in the US is extensive, ranging from Alamerica Bank in Alabama to Columbia Savings and Loan Association in. This week, we had the opportunity to support a neighboring community bank in our newest community. Columbia Savings & Loan in Milwaukee was started CITIZENS SAVINGS BANK AND TRUST COMPANY, NASHVILLE, TN ; CITIZENS TRUST BANK, ATLANTA, GA ; CITY FIRST BANK, NATIONAL ASSOCIATION (NOT BLACK OWNED. BLACK MANAGED). Over five decades later, Liberty Bank and Trust has over $1 billion in assets and branches in 11 states making it the largest black or African American owned.

How Do You Invest In Gold

There are many ways to invest in gold. Investors should consider the options available in their market, and the form of investment that is appropriate to their. Investing in gold isn't simple, especially for first-time investors. One reason is that there are so many ways to invest in gold, each with their own pros and. The most common way to invest in physical gold is to purchase gold bullion. Gold bullion refers to investment-grade gold, commonly in the form of bars, ingots. An actual fund traded on an exchange is designed to invest in platinum, gold, and silver. It's an easy and convenient way for customers to take the position in. As an online broker, we do not offer physical gold investment, but you can invest in gold mining stocks, ETFs and leveraged products. In this guide, we will explore various ways to invest in gold and provide tips on how to buy gold wisely. Silver is more sensitive to economic changes than gold, which has limited uses beyond jewelry and investment purposes. Gold can provide an important role in portfolios: diversification. Gold's ability to act as a “store of value” can help mitigate risk during times of market. Although people will have their own reasons to invest in gold, for many, gold investment is about preserving and protecting their wealth. There are many ways to invest in gold. Investors should consider the options available in their market, and the form of investment that is appropriate to their. Investing in gold isn't simple, especially for first-time investors. One reason is that there are so many ways to invest in gold, each with their own pros and. The most common way to invest in physical gold is to purchase gold bullion. Gold bullion refers to investment-grade gold, commonly in the form of bars, ingots. An actual fund traded on an exchange is designed to invest in platinum, gold, and silver. It's an easy and convenient way for customers to take the position in. As an online broker, we do not offer physical gold investment, but you can invest in gold mining stocks, ETFs and leveraged products. In this guide, we will explore various ways to invest in gold and provide tips on how to buy gold wisely. Silver is more sensitive to economic changes than gold, which has limited uses beyond jewelry and investment purposes. Gold can provide an important role in portfolios: diversification. Gold's ability to act as a “store of value” can help mitigate risk during times of market. Although people will have their own reasons to invest in gold, for many, gold investment is about preserving and protecting their wealth.

We can show you clearly how to buy the most trusted form of gold in the world, at the best prices, and in the safest, easiest way. Fidelity offers additional ways to gain exposure to precious metals. For example, you can purchase mutual funds and exchange-traded funds (ETFs) that invest in. These are some of the different ways in which you can invest in gold online on stock exchanges without the need to purchase any physical gold. Gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and. One of the simplest ways of obtaining gold as an investment is to buy investment bars and coins, from a bank or reputable dealer. When buying gold in these. Someone unsure about how much they should invest in gold may allocate just 3% of their funds to gold, but many investors will go up to 20% or beyond. It is. Investing in gold can offer portfolio diversification and an alternative to stocks and bonds. There are several ways to buy gold and other precious metals. There are several ways to make an investment in gold and thus obtain exposure to its price. We will explore. There are several ways to make an investment in gold and thus obtain exposure to its price. We will explore. Gold can therefore be beneficial in preserving wealth and limiting downside risk, but typically offers lower returns when stocks are doing well. Investing in gold can be done through various methods. Here are some common ways: Before investing in gold, it's important to do thorough research. These include supply and demand, the state of the global economy, and political uncertainty, all of which mean gold can be a highly volatile investment. You. With a DEGIRO account, there are several ways that you can invest in gold. As an online broker, we do not offer physical gold investment, but you can invest in. In this beginner's guide, we'll discuss the basics of how to invest with physical gold and other types of equities or ETFs. You can either buy physical gold like bars or gold coins, invest in gold mining company stocks or a gold exchange-traded fund, or ETF, or buy into gold futures. This guide will help you start investing money in the gold market. We'll explore all the ways you can invest in gold and discuss their pros and cons. There are different ways of investing in gold. Gold is used as a way to diversify risk by investors. It brings in the element of stability to a portfolio. Gold is traditionally viewed as a moderate-risk investment asset, serving as a money equivalent and universal payment. Importance, Understanding how to invest. In this beginner's guide, we'll discuss the basics of how to invest with physical gold and other types of equities or ETFs. The Perth Mint's range of investment products means you can buy gold and silver when and how you want to. Whether investing in precious metals for the first.

Stock Market Slang

In fact, many of the world's largest exchanges eliminated outcry and adopted a fully integrated electronic trading system including the London Stock Exchange . An interactive glossary of European capital markets and bank finance acronyms, slang, and terminology. The most common stock market slang words include "bear market" (a market in which prices are falling), "bull market" (a market in which prices are rising), and. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is currently willing to pay. Dow Jones Industrial Average (Dow) - The most commonly used indicator of stock market performance, based on prices of 30 actively traded blue chip stocks. In one of the trades, we will buy (or go long); in the other trade we will sell short. For example, we may have reason to believe the broader market is going to. Basic Forex terms and slang. You will learn the origins of Forex slang and the reasons that made the exchange community use special words. Find the latest SLANG Worldwide Inc. (SLGWF) stock quote, history, news Finance · My Portfolio · News · Latest News · Stock Market · Originals · Premium News. Bull and Bear: These popular terms are used to describe the overall market sentiment, the mood of investors and the general price direction of an asset. In fact, many of the world's largest exchanges eliminated outcry and adopted a fully integrated electronic trading system including the London Stock Exchange . An interactive glossary of European capital markets and bank finance acronyms, slang, and terminology. The most common stock market slang words include "bear market" (a market in which prices are falling), "bull market" (a market in which prices are rising), and. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is currently willing to pay. Dow Jones Industrial Average (Dow) - The most commonly used indicator of stock market performance, based on prices of 30 actively traded blue chip stocks. In one of the trades, we will buy (or go long); in the other trade we will sell short. For example, we may have reason to believe the broader market is going to. Basic Forex terms and slang. You will learn the origins of Forex slang and the reasons that made the exchange community use special words. Find the latest SLANG Worldwide Inc. (SLGWF) stock quote, history, news Finance · My Portfolio · News · Latest News · Stock Market · Originals · Premium News. Bull and Bear: These popular terms are used to describe the overall market sentiment, the mood of investors and the general price direction of an asset.

Wall Street Slang ; Bullish, To believe the market will go up. ; Buy & Hold, A foolish method of investing, when you buy a stock and completely forget about it. Bull or Bullish: This term refers to a strong market of stocks moving up. This can even be used to reference a specific position trader is taking. If they are. The latest SLANG Worldwide stock prices, stock quotes, news, and SLGWF history to help you invest and trade smarter. stock market. In addition, looking at the company's management, brand value This slang term is often used to express success or profitability in stock. 4. Markets climb a "wall of worry" Bull markets, or uptrending markets, are sometimes said to be climbing a "wall of worry," meaning stock prices are rising. Market Cap $M; Shares Outstanding M; Public Float M; Beta N/A; Rev. per Employee N/A; P/E Ratio N/A; EPS -$; Yield N/A; Dividend N/A; Ex-. SLGWF | Complete SLANG Worldwide Inc. stock news by MarketWatch. View Market Cap $M; Shares Outstanding M; Public Float M; Beta N/A; Rev. A market condition where stock prices are continually rising. Bull markets are characterized by optimism and excitement from traders and investors. Bear Market. It contains the basic terminology of traders who trade stocks in the stock market. We also added the exchange slang to the glossary. Start using ATAS for. Slang · Emoji · Memes · Acronyms · Gender and sexuality · All pop culture. Writing tips On Friday, the stock market hit new highs—even as wages were. Chinese stock trading slang · A股 (A-shares) - “Always down”: A-shares are mainland China stocks, and the joke suggests they are perpetually. Dow Jones Industrial Average (Dow) - The most commonly used indicator of stock market performance, based on prices of 30 actively traded blue chip stocks. stock market vocabulary. The wgcasino11.ru Glossary of financial and investing stock market. It's powered by the Hyper-textual Finance Glossary by. Arbitrage refers to buying and selling the same security on different exchanges and at different price points. If a stock trades at $10 on one exchange and. Not knowing stock market slang makes it hard to interpret trends and can lead to poor decisions! Read our list of stock market slang. Bull or Bullish: This term refers to a strong market of stocks moving up. This can even be used to reference a specific position trader is taking. If they are. Deciphering stock market lingo isn't remotely as tough as, say, cracking the Investing slang for the moment when you sell a losing security to avoid further. SLANG Worldwide Inc. Fundamentals Summary ; Market cap CA$m ; Revenue CA$m ; Earnings -CA$m. A financial market of a group of securities in which prices are rising or are expected to rise. The term "bull market" is most often used to refer to the stock. stock market vocabulary. The wgcasino11.ru Glossary of financial and investing stock market. It's powered by the Hyper-textual Finance Glossary by.

Microchip For Dogs Price

Cost of the microchipping is $25 and is offered at our vaccination clinics during our normal vaccination clinic hours. Isn't that peace of mind worth it? The. You can also get your pet microchipped at your veterinarian's office and at many mobile clinics in the area. Spay Neuter Network offers pet microchipping for. Microchip cost is $35 to $ It is best to do while dog is being spayed/neutered. Even with a chip, keep an id tag on his collar. NanoCHIP ID Pet Microchips (2nd generation). Smallest Available (mm). Free Shipping on All Orders with Easy Online Ordering. San Antonio residents who live within City limits can obtain FREE pet microchips (includes lifetime registration), there will be a $5 service fee per pet for. Microchipping your pet costs between $40 to $70, depending on where you choose to perform the procedure and the type of microchip you get. The cost per microchip is $10 per pet and ID tags are available at $5 each. Contact the Tulsa SPCA at , ext. for more information. Microchip cost is $35 to $ It is best to do while dog is being spayed/neutered. Even with a chip, keep an id tag on his collar. Chips are. Microchips cost around $7 wholesale and the implantation takes about 15 seconds. I'd say average cost is closer to $40 at the vet, but can be. Cost of the microchipping is $25 and is offered at our vaccination clinics during our normal vaccination clinic hours. Isn't that peace of mind worth it? The. You can also get your pet microchipped at your veterinarian's office and at many mobile clinics in the area. Spay Neuter Network offers pet microchipping for. Microchip cost is $35 to $ It is best to do while dog is being spayed/neutered. Even with a chip, keep an id tag on his collar. NanoCHIP ID Pet Microchips (2nd generation). Smallest Available (mm). Free Shipping on All Orders with Easy Online Ordering. San Antonio residents who live within City limits can obtain FREE pet microchips (includes lifetime registration), there will be a $5 service fee per pet for. Microchipping your pet costs between $40 to $70, depending on where you choose to perform the procedure and the type of microchip you get. The cost per microchip is $10 per pet and ID tags are available at $5 each. Contact the Tulsa SPCA at , ext. for more information. Microchip cost is $35 to $ It is best to do while dog is being spayed/neutered. Even with a chip, keep an id tag on his collar. Chips are. Microchips cost around $7 wholesale and the implantation takes about 15 seconds. I'd say average cost is closer to $40 at the vet, but can be.

On average, the cost can range from $25 to $ It's a small price to pay for the invaluable peace of mind it provides. What is the Best Age to Microchip a Dog? Current cost to microchip a non-shelter pet is $ For more information on chipping or to make an appointment, contact the shelter at Microchip Clinic Details CARE STL offers microchipping services for Dogs and Cats for $ This price includes registration for the animal's life when you. Microchips are available for only $60 and provide lifelong identification for your pet. A microchip can be easily placed in dogs and cats of any age. Microchip dog costs range from $25 to $60 depending on your device and veterinarian. Microchipping is a quick and simple procedure. The microchip is implanted. ACS offers low cost microchipping for $25 (includes registration) 11 a.m. – 5 p.m., every day except Wednesday. No appointment needed! Indianapolis Animal Care Services offers microchipping for your pet. You can access this service without an appointment during normal business hours. The fee. Microchips for Dogs - $40; Microchips for Cats - $25; Microchips for animals at time of redemption - $ If you are interested in scheduling a microchip or ID. The cost of a microchip is $ + taxes. This can be done in a minute appointment. It can also be implanted during an anesthetic procedure (often at a. Get the best deals on Pet Microchip when you shop the largest online selection at wgcasino11.ru Free shipping on many items | Browse your favorite brands. Low Cost Microchips ; Microchip (with surgery) $20 ; Microchip (during vaccine events) $30 ; Microchip Registration FREE*. Several different registries offer pet microchips, and each registry keeps its own database. Most registries charge a small upfront cost for a lifetime. For only $, you can microchip your pet and ensure their safety for life. Microchipping your cat or dog is a one-time procedure that will last a lifetime. Cost of the microchipping is $25 and is offered at our vaccination clinics during our normal vaccination clinic hours. Isn't that peace of mind worth it? The. Definitely, my microchip was $50 for my dog. Always ask for a price estimate before going to the vet. x 8 mm Microchip for Dogs Kit QR Code Dog Tag with Registration - Pack of 1 - International Standards ISO /5 and ISO Implant Chip for Cats. CAP provides microchip services daily to the public for the low cost of $ from 10AM-5PM daily. Whether you have your pet microchipped at CAP or at your. The average cost to have a microchip implanted by a veterinarian is around $45, which is a one–time fee and often includes registration in a pet recovery. The average cost to have a microchip implanted by a veterinarian is around $45, which is a one–time fee and often includes registration in a pet recovery. dogs, dog microchip, pet microchip, homeagain, dog chip, microchip scanner, pet id, dog microchip cost, dog id,Dog Supplies,Microchips.

1 2 3 4 5 6